We sat down with Siu Hardin, Manager, Tax Automation & Compliance for Brunswick, to learn how her team achieved huge time-savings throughout the compliance chain. She discusses using Corptax, Alteryx, and Power BI to automate time-consuming workflows and streamline processes and calculations.

Tell us a little about Brunswick.

We’re a global leader in marine recreation—and we recently acquired Navico, a global leader in marine electronics and sensors for $1.05 billion. We have an annual revenue of 6.8 billion dollars and operate in 29 countries. Our tax team consists of 14 professionals—12 in the Chicago area and two in Europe.

How did you get started using analytics tools?

We were experiencing many of the same challenges other tax departments deal with today. We had a lot of data to wrangle, a few team members retired, and with COVID, our team members were working remotely. It seemed like an ideal time to modernize manual processes, and the additional work related to the Navico acquisition made that all the more important. We began testing out tools we had available and favored leveraging analytics tools in the tax department.

Please share some examples of what you did.

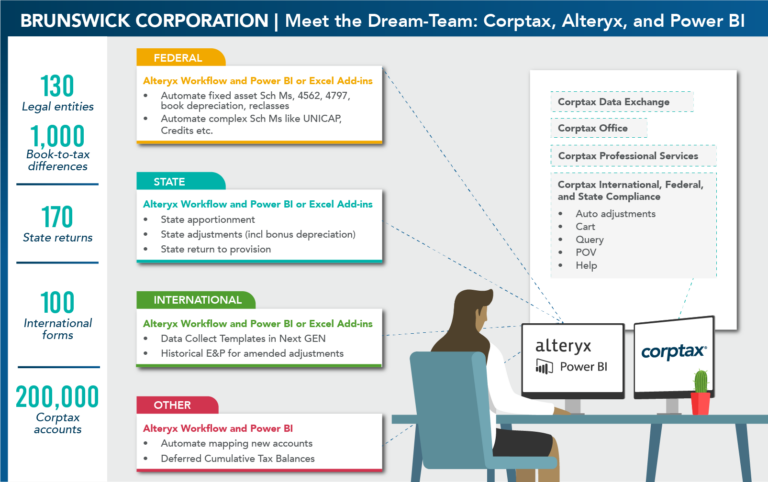

I’ll focus on our compliance process. Tax works with an enormous amount of compliance data. We manage data for 130 legal entities, and we process one thousand book-to-tax adjustments. Thankfully, many of our Schedule Ms are automated adjustments within Corptax. But for more complex or subjective Schedule Ms requiring judgement calls, we created new automated processes. Some big time-savers on the federal side were automating UNICAP and fixed asset Schedule Ms, calculating the fixed asset Schedule M, and uploading it to Forms 4562 and 4797 within Corptax.

On the state side, we file 170 state returns and have to collect data to file those returns, so we definitely needed to automate as much as possible and analyze the data.

For international, we moved to Corptax NextGen forms. That was fortunate because with the addition of Navico, we prepared one hundred 5471s (8858s).

I wrote an Alteryx program that maps new accounts to the appropriate Corptax account, (we have 200,000 accounts mapped in Corptax). This came in handy because in addition to acclimating to the new acquisition, we were changing our consolidation ERP. So, we used the Alteryx workflow to remap all of the new ERP accounts.

Which Corptax solutions and services do you use?

We use Corptax Data Exchange and Corptax Office to pull Corptax data and push it into Alteryx and Power BI—and we used Corptax Professional Services for guidance around that. Now, with the new Corptax Connectors for Alteryx and Power BI, we can improve our process even more. We’ll be able to pull Corptax data directly down to Alteryx and Power BI which is really exciting.

Brunswick has used Corptax for provision and compliance for many years. Even with our history and familiarity, we like to set aside a small budget for Professional Services’ help in new areas as we modernize. Like when we implemented the new international NextGen form, we engaged CPS to help us gather data. That worked out really well; they save us so much time.

Walk us through setting up a new analytics process.

For the various types and sources of data we need for our analytics process, I created an Alteryx workflow to transform the data, clean it, consolidate it, and then run the calculations. After the Alteryx workflow calculates and transforms all that data, we visualize the results in Power BI to review. Validations and calculations are all done, so the preparer becomes the reviewer. Then, I created dashboards to show results at both high and very detailed levels, and we use this for compliance and planning. Finally, I directed the Alteryx program to generate a Corptax file we upload into Corptax, usually through data imports.

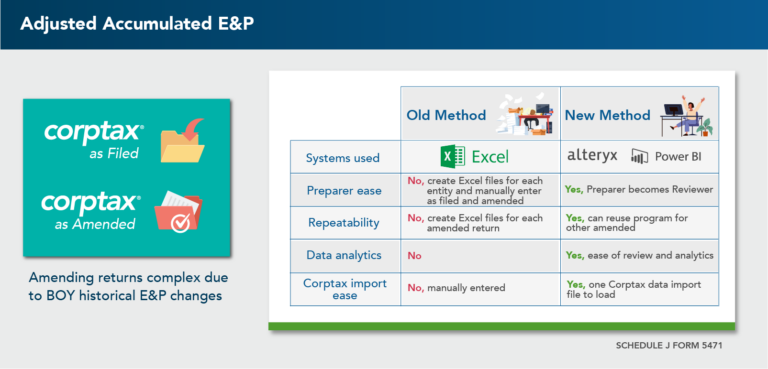

Here’s an example of a process change with NextGen forms that relates to Form 5471, Schedule J. For those familiar with Form 5471, you know Schedule J is where we report the roll forward of accumulated E&P. You start with a beginning balance and layer on current year activity to get to your end of year balance.

When we amend our prior year 5471s, our beginning of year E&P will change. And we have to reflect that change in our Schedule J. So the old way, we would create Excel files for these entities by looking at the as filed return and the as amended return—and then manually check. Was that change a C2? Was it a C3? Was it a Sub F? Was it a non Sub F? You get the idea. It was time-consuming. We don’t have the personnel or time to do it anymore, so I wanted to write an Alteryx workflow that would calculate the difference for us and produce a template to upload into Corptax.

This is where Corptax Professional Services came in. I explained what I wanted to design and needed help gathering specific data. Corptax knew exactly where to locate the as filed and as amended instances. The Alteryx program I wrote calculated the difference between the as filed and as amended data and created a Corptax upload to populate Schedule J. Again, preparers are able to step into more of a review role and visualize the results in Power BI at a high level or an entity level. Team members no longer create Excel sheets, so they spend their time on higher value activities. And once you’ve created your Alteryx program, you can repeat it.

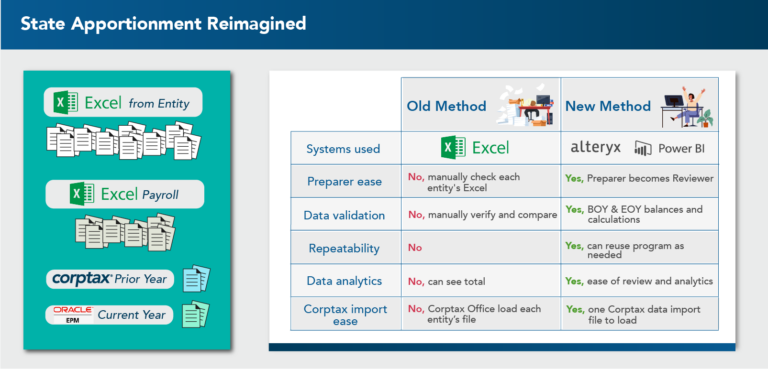

We also decided to tackle state apportionment. Our business units complete annual Excel files telling us how to apportion their sales, property, payroll, etc., by state and by entity. Using the old method, we would gather and manually review these files. Then, we’d look at the prior year data in Corptax to see if there were any big swings compared to current year. Finally, we’d look at the ERP data to make sure the Excel files we received tied to the trial balance. All extremely time-consuming.

So, I wrote an Alteryx workflow to open up all those Excel files—no human has to touch them. The program validates all those points, ticking and tying end of year sales, fixed assets—all of that—and aligns the data. After it runs, we visualize results in Power BI via tabs and dashboards. Once again, the program I wrote is fully repeatable.

The reviewer can review an entity on one screen. Only material items needing their attention are flagged. The ticking and tying is all done by Alteryx and Power BI.

Because of these efforts, we saved over 60 hours calculating historical E&P, automated 80% of Schedule M adjustments, and cut out 85% of manual entries for state. We were proud of the advancements we made and feel the results were well worth the time to set up our new processes.

How would you suggest choosing processes to automate?

My advice would be to first look for small wins that require less effort. An example of that was mapping the new accounts into Corptax accounts. Another good idea is selecting a project with the biggest return or impact. For example, how many people are doing the same thing…or which processes are people spending a lot of time working on? For us, addressing fixed assets on the federal return was a huge time saver, because we all did it and we all worked on our respective entities. And now it’s all uploaded and calculated for the team—and we simply have to review it.

Finally, any key learnings?

In regard to key learnings, process changes are the most successful when the team joins forces and works together. I’m really fortunate to work with a group of very intelligent, collaborative folks. We did put in an initial investment of time to build a better way, but it was worth it because the new processes have transformed the way we work.

See how Brunswick uses Alteryx and Power BI in action. View the on-demand webinar

About Siu Hardin, Manager, Tax Automation & Compliance, Brunswick

The 2022 Tax Transformer winner, Siu Hardin currently manages federal tax compliance, tax automation, and R&D tax credit for Brunswick. She has also led state compliance, state provision, indirect tax, and fixed assets. Siu has a CPA and Master’s degree in Taxation from the University of Illinois.