The Organization for Economic Co-operation and Development’s (OECD) Global Minimum Tax (GMT), part of Pillar Two, has been in the works since 2013—generating uncertainty and hindering company planning. That could be changing very soon. As of October 2022, almost 140 countries representing 90% of world GDP have agreed to the plan, and guidance has finally been issued. Knowing the GMT could seriously impact company growth strategy, senior leadership is looking to Tax for information.

In light of these developments, CSC Corptax® assembled a team of tax experts to discuss the GMT and factors tax teams may wish to consider when preparing. They also touch on the Corptax GMT solution designed to help tax departments source, process, and analyze data to ensure accurate reporting and support corporate planning.

What is the GMT and how could it affect MNEs?

The GMT levies a 15% tax on modified book income of MNEs doing business in participating countries. The tax would apply to MNEs with total sales exceeding €750 million globally and is anticipated to commence in 2024. Companies will need to calculate their effective tax rate on a jurisdiction-by-jurisdiction basis.

Representing a major change to international tax rules, the GMT could powerfully impact MNEs:

- It will hit the organization’s bottom line—both from a cash and financial net income perspective—and may drive companies to reevaluate investments.

- Tax will need more data and greater granularity to grapple with new and intricate calculations, adjustments, and forms, including the Income Inclusion and Under-taxed Profits rules.

- Tax may need new processes and systems to source necessary data.

- Greater coordination between local tax and finance departments and tax HQ will be essential; local experts who speak the language (literally and figuratively) may be critical.

- Companies must assess exposure, understand risk, and communicate with stakeholders as soon as possible.

- Tax teams need to ascertain the extent of GMT changes and line up resources to get the work done, entailing coordination throughout the organization.

Once businesses understand their full GMT burden, which may be onerous, they will be better positioned to advocate for themselves with lawmakers.

How is Corptax responding to proposed Pillar Two model rules for the GMT?

Corptax has been tracking Pillar Two developments at the OECD, US, and local country level since its inception. As soon as the OECD issued guidance for Pillar Two requirements, Corptax developed a global planning solution: CSC Corptax® Global Minimum Tax.

Corptax GMT allows customers to source, process, and analyze data needed to determine GMT impacts, answer questions from tax counsel and senior leadership, and share info with external stakeholders.

An out-of-the box solution, Corptax GMT offers reports, workpapers, calculations, and analytics essential to scenario modeling, risk assessment, and planning.

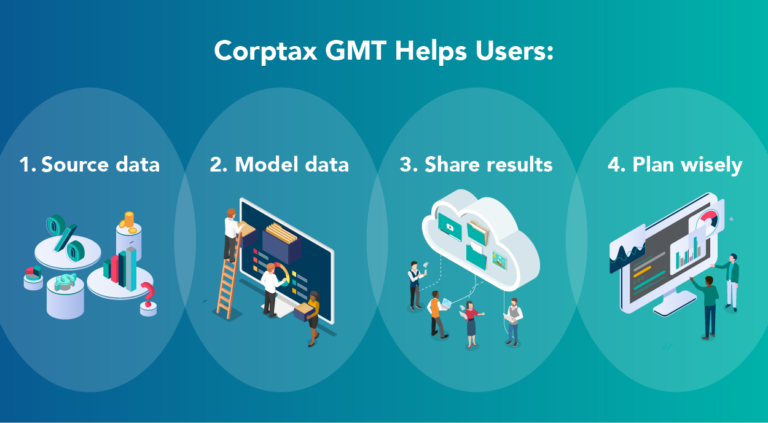

Corptax GMT helps users:

- Understand, source, and process data needed for GMT calcs

- Organize data to quickly model results with clear audit trails

- Share results with parties inside and outside the organization

- Identify jurisdictions at possible risk for a top-up tax and potential additional tax

Further, MNEs can reconcile GMT amounts to their book and tax amounts and document how results were determined.

Does Corptax GMT offer unique advantages?

Corptax single-system architecture streamlines data-sourcing. As Larry Goldstein, Corptax Senior Tax Analyst says, “Sourcing data is integral to measuring potential impacts. Corptax customers can grab compliance, provision, and international tax data from just one place for calcs and analytics—a huge advantage. We give clients data points other products just wouldn’t have.”

Further, clients can tweak data to align with GloBE income—the tax base defined by the OECD to determine minimum tax liability.

Corptax GMT also provides inputs for each adjustment included in OECD model rules. Complete audit trails track original book numbers through final numbers—providing detailed support to share with reviewers and taxing authorities. Once clients establish their data points in year one, they can use the same data points in year two, eliminating rework.

As further guidance, forms, and reporting requirements roll out, Corptax GMT will ensure users keep pace by providing the ability to post amounts back to the system, automate form prep, and more.

Does Corptax GMT help with the US 15% Corporate Alternative Minimum Tax?

After Corptax released Corptax GMT, the Inflation Reduction Act was signed into law. A component of the Act, the 15% Corporate Alternative Minimum Tax (AMT), will affect many of the same organizations implementing the GMT. Corptax GMT’s functionality also uses Corptax data for AMT calculations and analyses. Both Corptax GMT and AMT calculations leverage the same trial balance data—and Corptax GMT will include posted results of the AMT calculation in GMT’s covered taxes.

Ken Siegel, Corptax Director of Content Management & Design, sums it up, “We invest enormous resources into research, monitoring, and software development to make sure our clients get what they need to deliver to taxing authorities. And we continually enhance solutions as requirements evolve.”

For more information about Corptax GMT, contact 800.966.1639 or info@corptax.com. Corptax customers are encouraged to reach out to their Account Managers.